.svg)

Dutch SMBs are digital experts but frustrated with business software that shows financial data without letting them act on it. Embedded banking transforms these tools from passive dashboards into active financial platforms.

homeowners communities managed

of property managers in Spain using it

reduction of banking cost for communities

Industry

Use case

Location

In many places, SMBs still rely on paper, checks, or outdated tools. But in the Netherlands, they’ve already gone digital. Most use modern accounting software, expense platforms, and payment apps — and they expect the same seamless experience from every tool they use.

But too often, their business software still slows them down. With repetitive admin, disconnected financial workflows, and tools that stop short of letting them act on insights, Dutch SMBs are frustrated: their business software feels clunky compared to the smooth consumer apps they use daily.

The answer is embedded banking. And it's becoming essential for any platform hoping to stay relevant.

In the Netherlands, many SMBs use cloud-based software to manage everything from invoices to HR. These businesses expect automation, integration, and instant results.

Consumers are already used to:

They’re used to sending money with a tap, approving payments with a swipe, and getting real-time alerts and insights. So when they log into their accounting or cash flow tools and hit a wall, they notice.

One of the most common frustrations is that tools often show the financial situation of a freelancers or SMBs, but they can go no further. They’re unable to act on these insights. Many tools still only have the functionality to:

Instead, they’re forced to switch tabs, log into external bank accounts, copy-paste IBANs, re-authenticate every 90 days under PSD2 rules, and then reconcile manually. It’s clunky. It’s error-prone. And in a country where efficiency is the norm, it’s becoming increasingly unacceptable.

Embedded banking transforms business tools from passive dashboards into active financial platforms. It means your users can do more, without leaving your product.

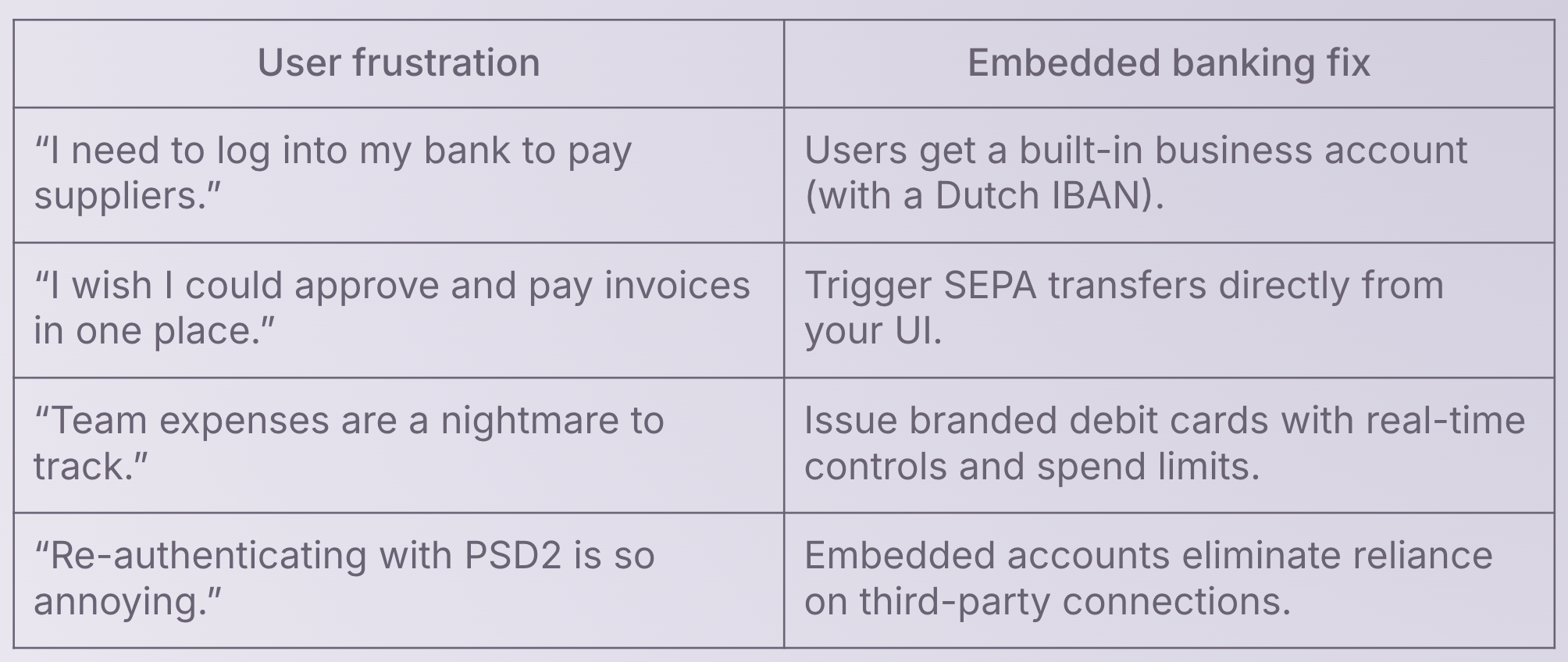

Here’s how embedded banking addresses key frustrations:

And it’s not just about smoothing out the experience. It’s about giving users what they actually want: control, speed, and integration.

By solving these pain points, embedded banking doesn’t just make your product better. It makes it indispensable.

Benefits for your platform:

Marnix van Deursen, Country Lead Benelux at Swan, explains:

“Dutch SMBs are among the most digital-savvy users in Europe. They expect their tools to do more, faster. Embedded banking gives platforms the capabilities users already assume are there.”

If this all sounds complex, the good news is: it doesn’t have to be.

Swan is a licensed electronic money institution, and our partners can operate under our license to offer banking features — without needing their own license, compliance infrastructure, or payments expertise.

With Swan, you can embed banking features like these directly into your platform:

Focus on building great features and serving your users, not navigating regulations.

Dutch SMBs expect more than ever. They’re used to smart, seamless apps in their personal lives, and they want the same simplicity at work. At the same time, they need to do more with less.

If you’re building tools for them, embedded banking isn’t just a bonus anymore — it’s what makes your product truly useful. It’s how you meet their real needs.

Summary

Customer stories

To use Apple Pay you need a supported card from a participating card issuer. To check if your card is compatible with Apple Pay, contact your card issuer. Apple Pay is not available in all markets. View Apple Pay countries and regions. Features are subject to change. Some features, applications, and services may not be available in all regions or all languages and may require specific hardware and software. For more information, see Feature Availability.